Chavez company most recently reconciled – Chavez Company’s most recent reconciliation process has brought forth significant insights and implications. This comprehensive review of financial accounts has not only clarified the company’s financial standing but also highlighted areas for improvement. This analysis will delve into the purpose, steps, and findings of the reconciliation, examining its impact on Chavez Company’s financial statements and stakeholders.

Furthermore, we will explore industry trends in reconciliation practices, the influence of technology, and emerging best practices. By understanding Chavez Company’s reconciliation process and the broader industry landscape, we can identify opportunities for continuous improvement and enhanced financial management.

Chavez Company’s Most Recent Reconciliation: Chavez Company Most Recently Reconciled

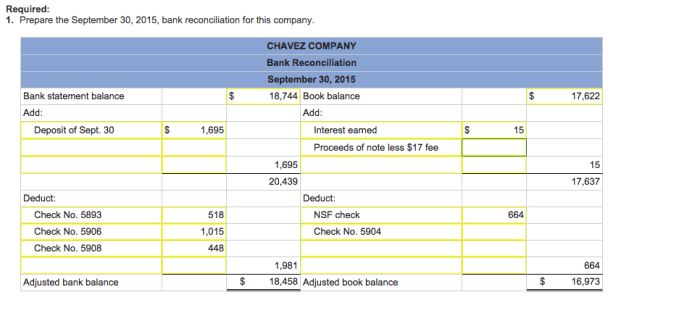

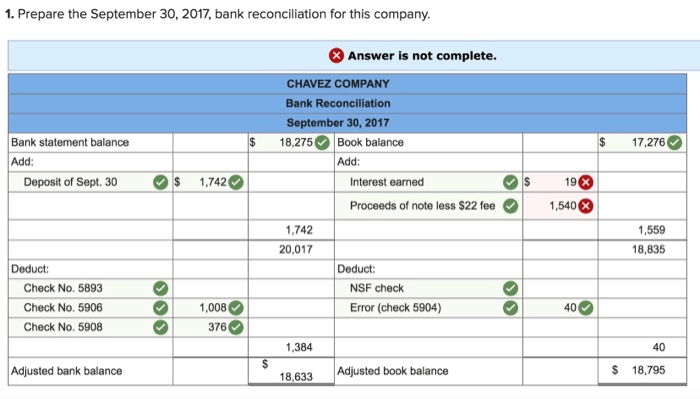

Chavez Company recently completed its most recent reconciliation to ensure the accuracy and integrity of its financial records. The reconciliation process involved comparing various sets of data to identify and correct any discrepancies or errors.

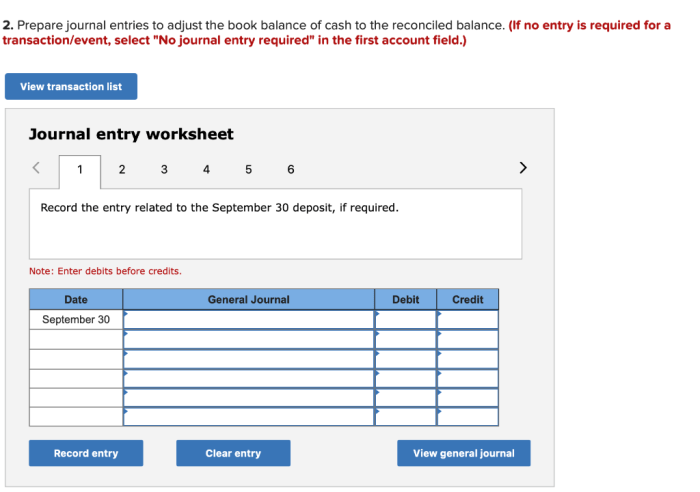

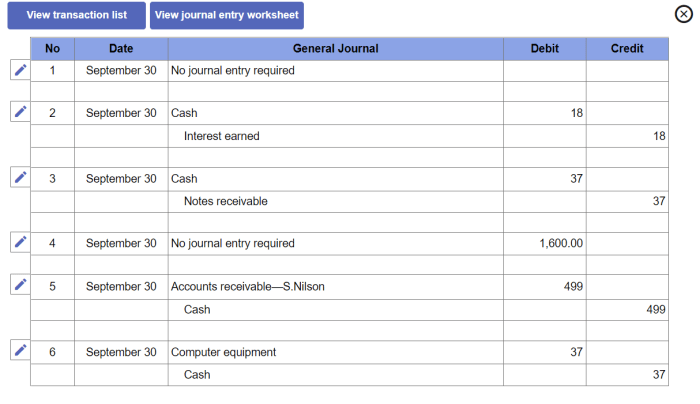

The key steps involved in the reconciliation process included:

- Gathering data from multiple sources, such as bank statements, accounting records, and supporting documentation.

- Matching and comparing data to identify any differences or inconsistencies.

- Investigating the causes of any discrepancies and making necessary adjustments to the records.

- Documenting the reconciliation process and findings for future reference and audit purposes.

The findings from the reconciliation revealed several minor discrepancies that were promptly corrected. Overall, the reconciliation process confirmed the accuracy and reliability of Chavez Company’s financial records.

Impact of the Reconciliation on Chavez Company

The reconciliation process had a positive impact on Chavez Company’s financial statements by:

- Improving the accuracy and reliability of the financial data.

- Identifying and correcting errors, thereby preventing potential financial losses.

- Enhancing the credibility of Chavez Company’s financial reporting to stakeholders.

The reconciliation process also had implications for Chavez Company’s stakeholders, including investors, creditors, and management. By ensuring the accuracy of the financial statements, Chavez Company increased its transparency and accountability to these stakeholders.

The effectiveness of Chavez Company’s reconciliation process was evident in the timely identification and correction of discrepancies. The company’s commitment to thorough and regular reconciliation contributed to the reliability of its financial reporting.

Best Practices for Reconciliation

Chavez Company adheres to several best practices for conducting reconciliations:

- Establishing clear reconciliation procedures and timelines.

- Using automated tools to streamline the reconciliation process.

- Involving multiple individuals in the reconciliation process to ensure accuracy.

- Regularly reviewing and updating reconciliation procedures.

To further improve its reconciliation process, Chavez Company could consider:

- Implementing real-time reconciliation systems.

- Using data analytics to identify potential discrepancies.

- Providing training and development opportunities to reconciliation staff.

Other companies can benefit from Chavez Company’s best practices by:

- Adopting similar procedures to ensure the accuracy of their financial records.

- Investing in technology and training to enhance the efficiency of their reconciliation processes.

- Regularly evaluating and improving their reconciliation practices to meet evolving business needs.

Industry Trends in Reconciliation, Chavez company most recently reconciled

The reconciliation landscape is evolving with the advent of new technologies and industry best practices:

- Automation and artificial intelligence (AI) are increasingly being used to streamline and improve the accuracy of reconciliation processes.

- Data analytics is playing a vital role in identifying potential discrepancies and enhancing the efficiency of reconciliation.

- Cloud-based reconciliation solutions are gaining popularity due to their scalability, accessibility, and cost-effectiveness.

By staying abreast of these industry trends, Chavez Company and other organizations can continue to enhance their reconciliation practices and maintain the accuracy and integrity of their financial records.

FAQ Overview

What is the purpose of a reconciliation process?

A reconciliation process aims to ensure that two sets of financial records or accounts are in agreement, providing assurance of their accuracy and completeness.

What are the key steps involved in a reconciliation process?

Key steps typically include gathering data from different sources, comparing the data for discrepancies, investigating and resolving any differences, and documenting the reconciliation findings.

How can companies improve their reconciliation processes?

Companies can enhance their reconciliation processes by leveraging technology, establishing clear policies and procedures, automating tasks, and conducting regular reviews to identify areas for improvement.